Learn what is it about

The “Discard Return” feature was introduced by the Income Tax Department on November 28, 2023 to simplify the income tax return filing process. This feature allows taxpayers to discard their tax returns instead of filing amended returns in case of an error, thus facilitating corrections. This alternative, which applies to returns submitted from April 1, 2023, is limited to cases where the return for the 2023-2024 assessment year –has not yet been validated.

The main difference between this model and the previous one is that taxpayers can delete returns prior to verification rather than filing a new one following verification. Nevertheless, the return is deemed a belated return and can be subject to penalties if it is submitted after the original deadline of July 31. The difference is as follows, simplified:

What is the “Discard” option of the ITR?

Taxpayers have to file their income details through ‘return of income’ if their income exceeds 3 lakhs. If an error was detected after filing, the return could be revised up to three months before the end of the assessment year or before the assessment is finalised, whichever is earlier. However, if you want to file a revised tax return after an original tax return has been filed, the original tax return needed verification even if an error was found.

With the “Discard” feature available on the Income Tax e- filing website (www.incometax.gov.in), taxpayers can permanently delete their filed tax returns without verifying them.

In other words,

Once a tax return is verified and filed and then revised, the trail remains and this trail may lead to a query from the Income Tax Department. So, if the taxpayer finds errors or omissions after filing the tax return, he can now use the “Discard ITR” option. In this case, they do not necessarily have to compulsorily verify a wrong return and then revise it, thereby exposing themselves to the risk of a query from the tax authorities.

If an incorrect income was declared this year that should have been declared next year, the return and then revising the ITR without this income was subsequently suppressed and the ITR revised after the declaration has been checked and the ITR subsequently revised without this income. However, if the ‘Discard Return” option is used, such undue litigation can be avoided.

Once the tax return is discarded, it is removed from the records of the authority without the taxpayer having the opportunity to retrieve it.

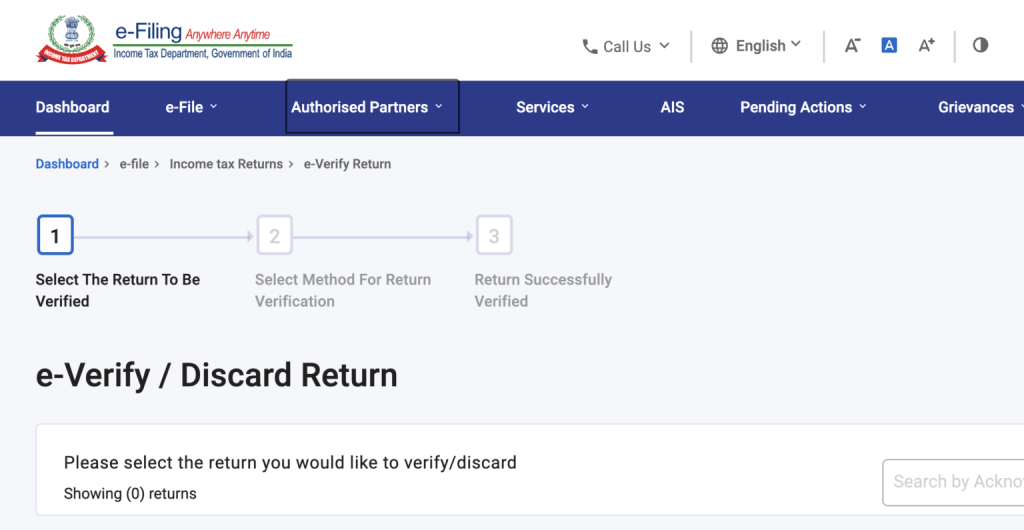

How to discard the ITR?

The process is quite simple: log in to the e-filing portal, navigate to “Income Tax Return” and select “e-Verify ITR” where the “Discard” option is available. However, filing a new return after the original one has been discarded after the due date (July 31) will result in penalties as it will be considered late.

What to do if you need to file the declaration after the due date?

“Users can use the “Discard” option “for the ITRs filed under section 139(1) / 139(4) / 139(5) if they do not wish to verify the same. The user has the option to resubmit an ITR after discarding the previous unverified ITR. However, if the “ITR filed u/s 139(1)” is discarded and the subsequent return is filed after the due date u/s 139(1), it would attract the consequences of late return like 234F etc. Therefore, it is advised to check whether the due date for filing the return u/s 139(1) is available or not before discarding a previously filed return,” reads the Income Tax website.

If you must discard the original ITR under section 139(1) after the due date, select section 139(4) for filing a subsequent return.

If you have sent your ITR verification to the CPC and it has not been reached, the option to discard still cannot be exercised. “The user may not discard such declarations if the ITR-V has already been sent to the Central Processing Centre (CPC). There is an obligation to do so before discarding the return,” the income tax website states.

As long as the “ITR status” is “Unverified” or “Pending for verification”, the “Discard” option can be used indefinitely.